Following the new additions to EU Anti-Money Laundering laws in effect from January 2020, letting agents will need to make sure they are compliant with the Fifth Anti-Money Laundering Directive (5AMLD).

GOV.UK states that "any letting agency businesses that were brought into scope on 10 January 2020, must register with HMRC before 10 June 2021" in order to stay compliant with AML legislation.

What is 5AMLD?

The 5AMLD builds on the Fourth Anti-Money Laundering Directive, driven by the intergovernmental Financial Action Task Force (FATF), to address money laundering across EU member states, still applicable to the UK. By including amendments stemming from the European Commission’s 2016 Action Plan, the 5AMLD aims to tackle the use of the financial system for the funding of criminal activities, terrorist financing and corruption. The new regulations came into effect on 10th January 2020 and for the first time letting agencies will be within the remit of the Money Laundering Regulations.

How does 5AMLD affect Letting Agencies?

The new regulations mean that letting agents operating in the EU and the UK will have to make sure they comply with the enhanced checks on tenants and landlords.

All tenancy agreements with a rent in excess of €10,000 (the equivalent of £8700) per calendar month will be bound by the regulations, which includes both residential and commercial property.

This means that letting agents will be most affected by the “Know Your Customer (KYC)” amendments and the checks that require Enhanced Due Diligence of some clients from countries deemed “high risk”. Landlords and tenants who fall into the relevant category of rent in excess of €10,000 per property per month should prepare themselves for more questions, administration and Enhanced Due Diligence checks.

Additional checks required might include but are not limited to:

- Verification that the tenancy is genuine and not set up to assist in the cleaning of crime proceeds

- ID checks

- On-going monitoring of tenancies (for tenancies with rent in excess of €10,000 per month) to ensure that the risk of money-laundering remains low

Letting agencies must comply with the 5AMLD directives, meaning they must:

- Carry out Enhanced Due Diligence on all clients and keep records of these checks. Theses checks will not just prove identity but provide evidence of legitimate funds

- Have a comprehensive written policy and procedures to deal with money laundering in place

- Maintain records and regularly check that the anti-money laundering procedures in place are being followed correctly by staff

- Designate a person within the business to act as a Money Laundering Reporting Officer and a deputy. This person will be responsible for keeping track of changing legislation and processes to ensure compliance

- Train and support staff to understand and implement these policies. Staff should be well trained to recognise suspicious activity with a robust system in place for reporting their suspicions

- Carry out screenings of new staff to ensure integrity in the workplace and avoid conflict of interest

- Ensure vetting of personal connections between staff, sellers, buyers or landlords to avoid risk of illegal activity

We understand that this legislation may not impact some agents at all, as the monthly threshold is quite high, however we believe that it is still important to keep up to date with the ongoing changing legislation. Even for agents with 1-2 high end rental properties, there is a considerable amount of work to be done.

What happens after Brexit?

Although the UK left the European Union on 31st January 2020 and the transition period ended on 31 December 2020, letting agents still have to be compliant with the 5AMLD.

There have been no immediate changes to AML legislation in the UK since the end of the Brexit transition period. The UK transposed the 5AMLD into current UK law (The Money Laundering and Terrorist Financing Regulations 2019) and the government has not announced any proposals to change or update these requirements. Although a 6th Anti-Money Laundering Directive has been introduced in the EU, the UK has opted out of complying with this; UK legislation is already largely compliant with these new measures and in fact “already goes much further”.

How can RentProfile help?

Even if the current legislation looks at properties with a rental income in excess of €10,000 per month, which may seem high, we can run valuable checks to make sure that as a letting agency, you are not going to be defrauded, run into trouble with the regulators or have any legal issues with tenants. In reports conducted to date, approximately 10% of landlord checks fail, usually due to ownership records not matching, though AML matches would also occur. Above all, it is worthwhile making sure that you are dealing with trustworthy individuals of reputable standing, especially if those people are politically exposed.

In our experience, we have come across many challenging cases where for example, properties are owned by other companies operating overseas and the companies themselves are owned by the subsidiary of another company or a trust in a third country. The challenge here is gaining access to data in different jurisdictions to be able to effectively demonstrate, with confidence, that you have investigated who the beneficial owners are. This is where we can help you offset the risk by using our service.

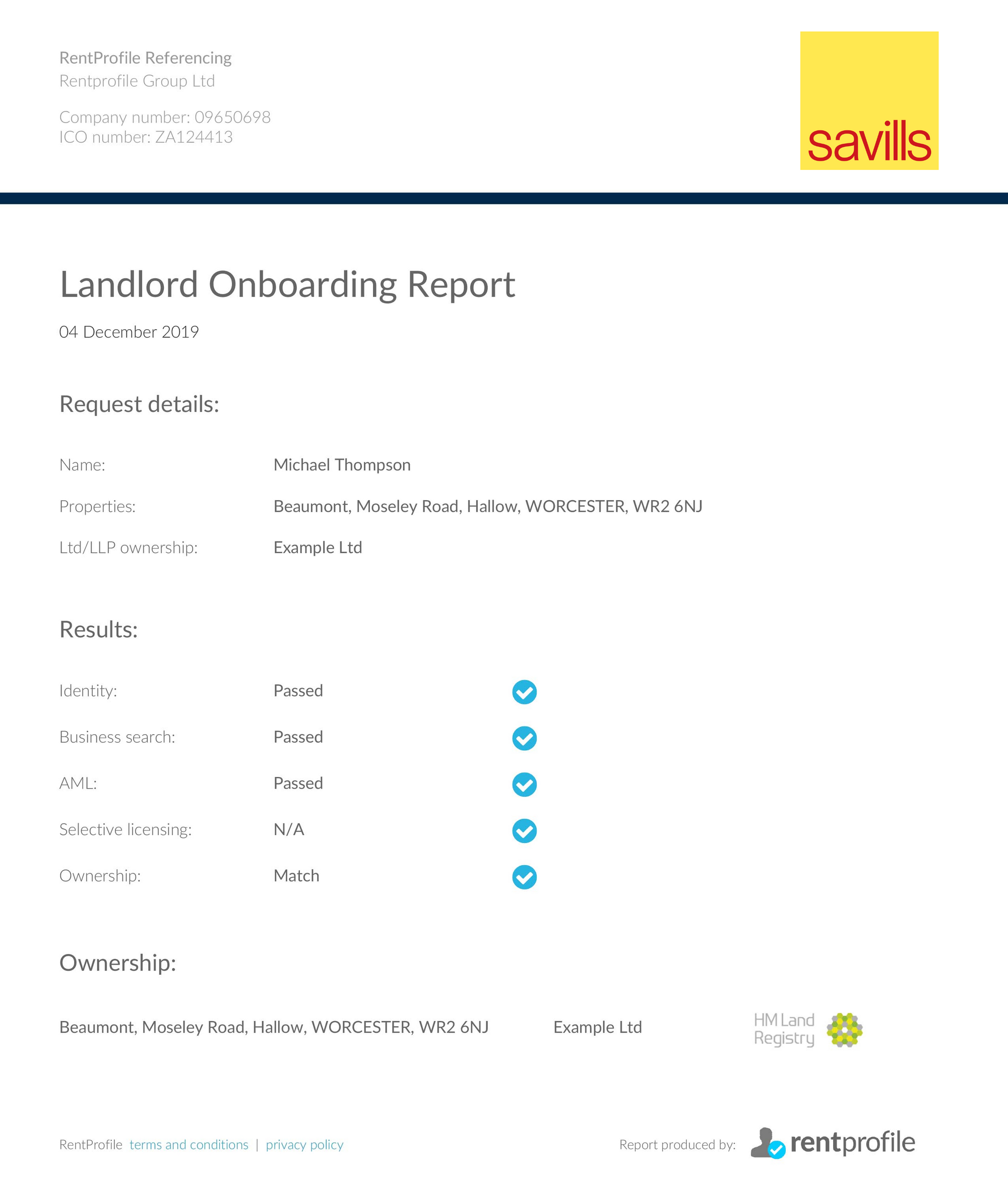

At RentProfile, we have developed a comprehensive Landlord Check report in conjunction with Savills, which complies perfectly with the 5AMLD due diligence requirements. Our reliable Landlord AML solution includes:

- Identity, Beneficial Owner, AML, Property Ownership, Licensing checks

- Meets requirements for the Fifth Money Laundering Directive (5AMLD)

- Global coverage. Ability to verify Beneficial Owner of international ownership

- Streamlined approach with a fast turnaround

Understanding the changes from the new directives is important if not time-consuming so we’ve worked hard to make sure we can help agents stay ahead of the curve and not get caught out in non-compliance. If you’re interested to learn more about our product, please contact us or feel free to read our GOV.UK case study with the Land Registry.

Disclaimer: This blog post is intended for general information purposes and should not be construed as legal advice or official guidance.